Market and Economy

Just two years after the start of the COVID pandemic, the world experienced another major shock when Russia invaded a free and independent Ukraine. The incursion has exacerbated inflation, already high. All the major asset classes we follow fell in the first quarter. As investors digested the news, stocks rallied over the final two weeks of March from a quarter low of -12.5% for the S&P 500, to end down only -4.6%.

Tough quarter for bonds

Bonds, however, steadily crept lower as interest rates started rising from artificially low levels, marking the third-worst quarterly return for the Barclays US Aggregate Bond Index since 1980, around the last time inflation was this high. It may look like dark times for bonds right now but this doesn’t necessarily mean the downward trend will continue. Historically, the two worst quarterly returns for the bond index both occurred in 1980, a year in which the Federal Reserve pushed the Fed Funds rate as high as 19.5% (compared to the current upper limit of 0.5%), and yet the US Aggregate Bond Index still earned a positive +2.7% return for that year.

War in one country but on a global scale

Even more than bad news, markets dislike uncertainty, and no one, outside of Vladimir Putin, knows what Russia will do next. In February, Russia’s invasion effectively ended 31 years of improving freedoms, growth, and integration for Ukraine and now the Ukrainian people are suffering.

War itself is inflationary as demand for supplies and weapons competes with everything else that needs to be produced. On top of that, the US and Europe are waging a financial war against Russia through economic sanctions and asset seizures, further spurring inflation, particularly in energy prices. We entered 2022 in a bit of an energy shortage with Brent Crude prices elevated at $78 a barrel but the cost spiked up above $139/barrel in early March. We are all feeling pain at the pump now with gas prices up by about a dollar across the country, which equates to about $1,000 in extra annual costs for the average family.

This war could end tomorrow or continue to drag on. Either way, many countries around the world are now less willing to trade with Russia going forward. We will likely see a larger push in western nations to become energy independent, which could include increased local drilling for fossil fuels or increased renewable energy investment.

Only about 2% of the oil used in the US traditionally comes from Russia. Now that we have stopped buying Russian oil, we will need to invest in added drilling or find other sources, both of which will likely take six months or more to be up and running. This means higher gas prices may last throughout most of 2022. For now, President Biden is releasing oil from strategic reserves to help make up the shortfall.

Adding fuel to the (inflation) fire

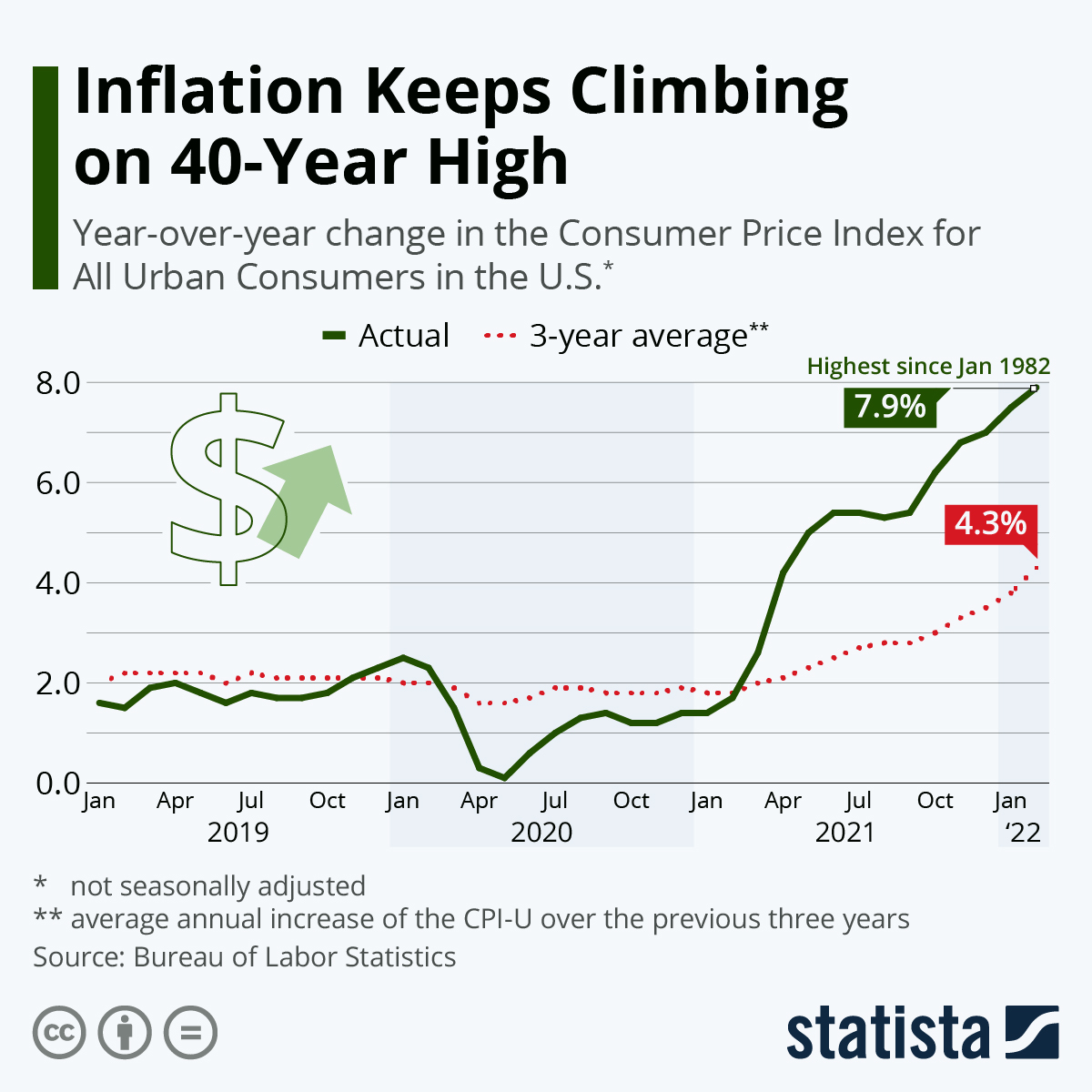

COVID-related supply shortages and transportation challenges coupled with unprecedented government infusions of stimulus cash into the economy had already resulted in surging inflation. After running at less than 2% for the prior decade, inflation measured 7% in 2021, as measured by the Consumer Price Index. Russian sanctions and new shortages in oil, wheat, nickel, and other commodities, haven’t helped. The CPI reading for February showed a 0.8% increase (about 10% annualized), the highest reading since January 1982. The largest jump in prices has come from energy costs, up 25.6% over the past twelve months.

Price increases that experts believed would be short-lived aren’t going away anytime soon and investors, businesses, and consumers are shifting expectations accordingly. Likewise, the Federal Reserve has gone through a major change in thinking. Now that unemployment has fallen to 3.6%, the Fed has put its full focus on tamping down inflation.

Interest rates have trended lower for the past four decades but that appears to be changing. Entering 2022, Fed officials expected to raise the Fed Funds rate by 0.75% but now expect to up that to 1.75% with an upper limit of 2.0%, to be followed by another 1.0% increase in 2023. The Fed Funds rate impacts the interest rates at which banks borrow money and rate hikes raise borrowing costs for everyone. Though the Fed only just made the first increase of 0.25% in March, interest rates have already moved up to reflect the expected increases.

While asset prices fell across the board in the first quarter, the economy is still on track for continued growth. Overcoming higher costs, US GDP grew by 5.7% in 2021 and current estimates show further growth of roughly 2% in 2022. That’s not spectacular but still very impressive considering current headwinds.

Unfortunately, the only solution to high inflation is higher prices to lower demand. The Fed has a difficult job ahead. If the Fed raises rates too slowly, the economy can overheat as rising demand for goods and services pushes costs beyond what most are able to pay and we can end up with a recession. If the Fed raises rates too quickly, borrowing can become so expensive that spending and investment are squeezed off and we can end up with a recession. Threading the needle to give us a so-called “soft” landing is not an easy job in normal circumstances, but not knowing what Putin will do adds more complications.

Despite a major paradigm shift in inflation and interest rates, earnings are holding up. So far, companies have succeeded in passing through higher costs to customers and have maintained high profit margins. Following record fourth-quarter earnings, S&P 500 company profits are expected to rise by 4.8% in the first quarter and 9.0% for all of 2022, according to FactSet. This just goes to show that the drop in asset prices so far this year is just a reflection of changing valuations and not weak fundamentals.

Value definitely still matters

The drop seen in stock prices has not been uniform. It is easy to see how international stocks have underperformed US stocks. Europe’s economy is fairly intertwined with Russia, in large part due to a reliance on Russian oil and gas. Sanctions have created friction for European countries even as they care for over 4 million Ukrainians who have fled their homeland. The US, on the other hand, is well insulated from Russia and sanctions imposed by our government won’t have much overall effect on our economy aside from higher prices at the pump. With a murky future, it is hard to say if we are seeing a buying opportunity for international equities, or if prices will continue to be weighed down.

Growth stocks also underperformed value by a good margin. The S&P 500 Value Index held up with just a 0.7% loss in the first quarter and was never down more than 6.5% while the S&P 500 Growth Index fell 8.8% and was down over 18.5% in mid-March.

On top of elevated corporate costs, higher expected inflation impacts how companies are valued. If you think of inflation as lowering the value of what a dollar will buy you in the future, growth stocks become less valuable as inflation rises because most of their earnings are expected way out in the future. Many value stocks, however, will earn more in the near future in dollars that are worth more today.

Framing valuations this way, you can see why growth stocks performed so well during the bull market that began in 2009. If inflation remains higher for longer, value may continue to be an appealing investment.

Investors start a new chapter

We have received a few calls from investors with great questions about what we’re doing about inflation and/or Russia’s war. We don’t know what’s going to happen next but can say that we have been preparing for this for years. Diversification isn’t about preparing for the bad outcomes you can predict but the ones that you can’t predict. We balance risk across a wide spectrum of investments, knowing that the winners should more than make up for the losers over time. For that reason, we have been telling clients that we’re sticking to the plan.

Most asset classes stumbled out of the gate in the first quarter, but there was a lot of new information to digest. The good news is that we appear to have moved on from COVID disruptions but unfortunately, new issues have taken center stage. In the past, geopolitical shocks to the market have generally been short-lived as investors tend to adjust to new expectations quickly.

Stock Market Reactions to Geopolitical Events

|

|

S&P 500 Index |

Days to |

| Market Shock Events |

Event Date |

Initial Drawdown |

Total Drawdown |

Bottom |

Recovery |

| North Korean Missile Crisis |

7/28/2017 |

-0.1% |

-1.5% |

14 |

36 |

| Arab Spring Reaches Libya |

2/20/2011 |

-2.8% |

-6.4% |

24 |

27 |

| US Terrorist Attacks |

9/11/2001 |

-4.9% |

-11.6% |

11 |

31 |

| Iraq’s Invasion of Kuwait |

8/2/1990 |

-1.1% |

-16.9% |

71 |

189 |

| Reagan Shooting |

3/30/1981 |

-0.3% |

-0.3% |

1 |

2 |

| Tet Offensive |

1/30/1968 |

-0.5% |

-6.0% |

36 |

65 |

| Kennedy Assassination |

11/22/1963 |

-2.8% |

-2.8% |

1 |

1 |

| Cuban Missile Crisis |

10/16/1962 |

-0.3% |

-6.6% |

8 |

18 |

| N. Korea Invades S. Korea |

6/25/1950* |

-5.4% |

-12.9% |

23 |

82 |

| Average |

|

-2.0% |

-7.2% |

21 |

50 |

* The modern design of the S&P 500 Index was first launched in 1957. Performance before then incorporates the performance of its predecessor index, the S&P 90.

Source: LPL Research, S&P Dow Jones Indices, CFRA, 01/06/2020, SSGA Research, Bloomberg. Past performance is not a guarantee of future results |

However, the extended period of low inflation and near-zero interest rates may have already come to an end, leaving us with a new path forward. The Fed’s tightening policy along with a drawn-out war will weigh heavily on the market but that doesn’t mean the first quarter is the start of a downward trend. So far, earnings and the economy look to continue growing, which means our investments can further appreciate—we just may not see more of the stellar returns we have enjoyed since the financial crisis.

What Does It Mean to be Tax Diversified?

March 9, 2022Ping Pong: 1st Quarter 2022 Commentary

March 31, 2022Market and Economy

Just two years after the start of the COVID pandemic, the world experienced another major shock when Russia invaded a free and independent Ukraine. The incursion has exacerbated inflation, already high. All the major asset classes we follow fell in the first quarter. As investors digested the news, stocks rallied over the final two weeks of March from a quarter low of -12.5% for the S&P 500, to end down only -4.6%.

Tough quarter for bonds

Bonds, however, steadily crept lower as interest rates started rising from artificially low levels, marking the third-worst quarterly return for the Barclays US Aggregate Bond Index since 1980, around the last time inflation was this high. It may look like dark times for bonds right now but this doesn’t necessarily mean the downward trend will continue. Historically, the two worst quarterly returns for the bond index both occurred in 1980, a year in which the Federal Reserve pushed the Fed Funds rate as high as 19.5% (compared to the current upper limit of 0.5%), and yet the US Aggregate Bond Index still earned a positive +2.7% return for that year.

War in one country but on a global scale

Even more than bad news, markets dislike uncertainty, and no one, outside of Vladimir Putin, knows what Russia will do next. In February, Russia’s invasion effectively ended 31 years of improving freedoms, growth, and integration for Ukraine and now the Ukrainian people are suffering.

War itself is inflationary as demand for supplies and weapons competes with everything else that needs to be produced. On top of that, the US and Europe are waging a financial war against Russia through economic sanctions and asset seizures, further spurring inflation, particularly in energy prices. We entered 2022 in a bit of an energy shortage with Brent Crude prices elevated at $78 a barrel but the cost spiked up above $139/barrel in early March. We are all feeling pain at the pump now with gas prices up by about a dollar across the country, which equates to about $1,000 in extra annual costs for the average family.

This war could end tomorrow or continue to drag on. Either way, many countries around the world are now less willing to trade with Russia going forward. We will likely see a larger push in western nations to become energy independent, which could include increased local drilling for fossil fuels or increased renewable energy investment.

Only about 2% of the oil used in the US traditionally comes from Russia. Now that we have stopped buying Russian oil, we will need to invest in added drilling or find other sources, both of which will likely take six months or more to be up and running. This means higher gas prices may last throughout most of 2022. For now, President Biden is releasing oil from strategic reserves to help make up the shortfall.

Adding fuel to the (inflation) fire

COVID-related supply shortages and transportation challenges coupled with unprecedented government infusions of stimulus cash into the economy had already resulted in surging inflation. After running at less than 2% for the prior decade, inflation measured 7% in 2021, as measured by the Consumer Price Index. Russian sanctions and new shortages in oil, wheat, nickel, and other commodities, haven’t helped. The CPI reading for February showed a 0.8% increase (about 10% annualized), the highest reading since January 1982. The largest jump in prices has come from energy costs, up 25.6% over the past twelve months.

Price increases that experts believed would be short-lived aren’t going away anytime soon and investors, businesses, and consumers are shifting expectations accordingly. Likewise, the Federal Reserve has gone through a major change in thinking. Now that unemployment has fallen to 3.6%, the Fed has put its full focus on tamping down inflation.

Interest rates have trended lower for the past four decades but that appears to be changing. Entering 2022, Fed officials expected to raise the Fed Funds rate by 0.75% but now expect to up that to 1.75% with an upper limit of 2.0%, to be followed by another 1.0% increase in 2023. The Fed Funds rate impacts the interest rates at which banks borrow money and rate hikes raise borrowing costs for everyone. Though the Fed only just made the first increase of 0.25% in March, interest rates have already moved up to reflect the expected increases.

While asset prices fell across the board in the first quarter, the economy is still on track for continued growth. Overcoming higher costs, US GDP grew by 5.7% in 2021 and current estimates show further growth of roughly 2% in 2022. That’s not spectacular but still very impressive considering current headwinds.

Unfortunately, the only solution to high inflation is higher prices to lower demand. The Fed has a difficult job ahead. If the Fed raises rates too slowly, the economy can overheat as rising demand for goods and services pushes costs beyond what most are able to pay and we can end up with a recession. If the Fed raises rates too quickly, borrowing can become so expensive that spending and investment are squeezed off and we can end up with a recession. Threading the needle to give us a so-called “soft” landing is not an easy job in normal circumstances, but not knowing what Putin will do adds more complications.

Despite a major paradigm shift in inflation and interest rates, earnings are holding up. So far, companies have succeeded in passing through higher costs to customers and have maintained high profit margins. Following record fourth-quarter earnings, S&P 500 company profits are expected to rise by 4.8% in the first quarter and 9.0% for all of 2022, according to FactSet. This just goes to show that the drop in asset prices so far this year is just a reflection of changing valuations and not weak fundamentals.

Value definitely still matters

The drop seen in stock prices has not been uniform. It is easy to see how international stocks have underperformed US stocks. Europe’s economy is fairly intertwined with Russia, in large part due to a reliance on Russian oil and gas. Sanctions have created friction for European countries even as they care for over 4 million Ukrainians who have fled their homeland. The US, on the other hand, is well insulated from Russia and sanctions imposed by our government won’t have much overall effect on our economy aside from higher prices at the pump. With a murky future, it is hard to say if we are seeing a buying opportunity for international equities, or if prices will continue to be weighed down.

Growth stocks also underperformed value by a good margin. The S&P 500 Value Index held up with just a 0.7% loss in the first quarter and was never down more than 6.5% while the S&P 500 Growth Index fell 8.8% and was down over 18.5% in mid-March.

On top of elevated corporate costs, higher expected inflation impacts how companies are valued. If you think of inflation as lowering the value of what a dollar will buy you in the future, growth stocks become less valuable as inflation rises because most of their earnings are expected way out in the future. Many value stocks, however, will earn more in the near future in dollars that are worth more today.

Framing valuations this way, you can see why growth stocks performed so well during the bull market that began in 2009. If inflation remains higher for longer, value may continue to be an appealing investment.

Investors start a new chapter

We have received a few calls from investors with great questions about what we’re doing about inflation and/or Russia’s war. We don’t know what’s going to happen next but can say that we have been preparing for this for years. Diversification isn’t about preparing for the bad outcomes you can predict but the ones that you can’t predict. We balance risk across a wide spectrum of investments, knowing that the winners should more than make up for the losers over time. For that reason, we have been telling clients that we’re sticking to the plan.

Most asset classes stumbled out of the gate in the first quarter, but there was a lot of new information to digest. The good news is that we appear to have moved on from COVID disruptions but unfortunately, new issues have taken center stage. In the past, geopolitical shocks to the market have generally been short-lived as investors tend to adjust to new expectations quickly.

Stock Market Reactions to Geopolitical Events

Source: LPL Research, S&P Dow Jones Indices, CFRA, 01/06/2020, SSGA Research, Bloomberg. Past performance is not a guarantee of future results

However, the extended period of low inflation and near-zero interest rates may have already come to an end, leaving us with a new path forward. The Fed’s tightening policy along with a drawn-out war will weigh heavily on the market but that doesn’t mean the first quarter is the start of a downward trend. So far, earnings and the economy look to continue growing, which means our investments can further appreciate—we just may not see more of the stellar returns we have enjoyed since the financial crisis.

SEE ALSO:

Ping Pong: 1st Quarter 2022 Commentary, Published by Benton Bragg, CFA, CFP®More About...

Trump Accounts: A New Vehicle for Long-Term Savings

Read more

Understanding the One Big Beautiful Bill and Its Tax Changes

Read more

Investment Ingredients: Combining Assets for Optimal Returns

Read more

Harvesting the Loss: When Does It Make Sense?

Read more

Playing Catch-Up: Making Extra Contributions for Retirement

Read more

The Tortoise and the Hare: Why Most Investment Predictions Fall Short

Read more