Market and Economy

What a difference a year makes! With the world shut down a year ago, stocks were experiencing the most abrupt bear market in US history. Four consecutive quarters of rising stocks later and investors who stayed the course have been rewarded with a spectacular 12-month return. All the major stock indexes we track have reached new all-time highs in the past few months.

The economy is reopening as vaccine distribution accelerates and new government stimulus encourages companies and consumers to put a glut of cash savings to use. Optimism is clearly rising and has spread across all facets of the stock market.

The big winners during last year’s COVID shutdowns were the tech-oriented companies that helped us work, shop, and entertain ourselves from home. As vaccination counts grow and we venture back out into the world, the other, harder-hit companies are rising as “recovery” stocks have recently outpaced “pandemic” stocks. The disparity is obvious looking at how much small-company stocks have outperformed their larger peers over the last 12 months.

American Rescue Plan

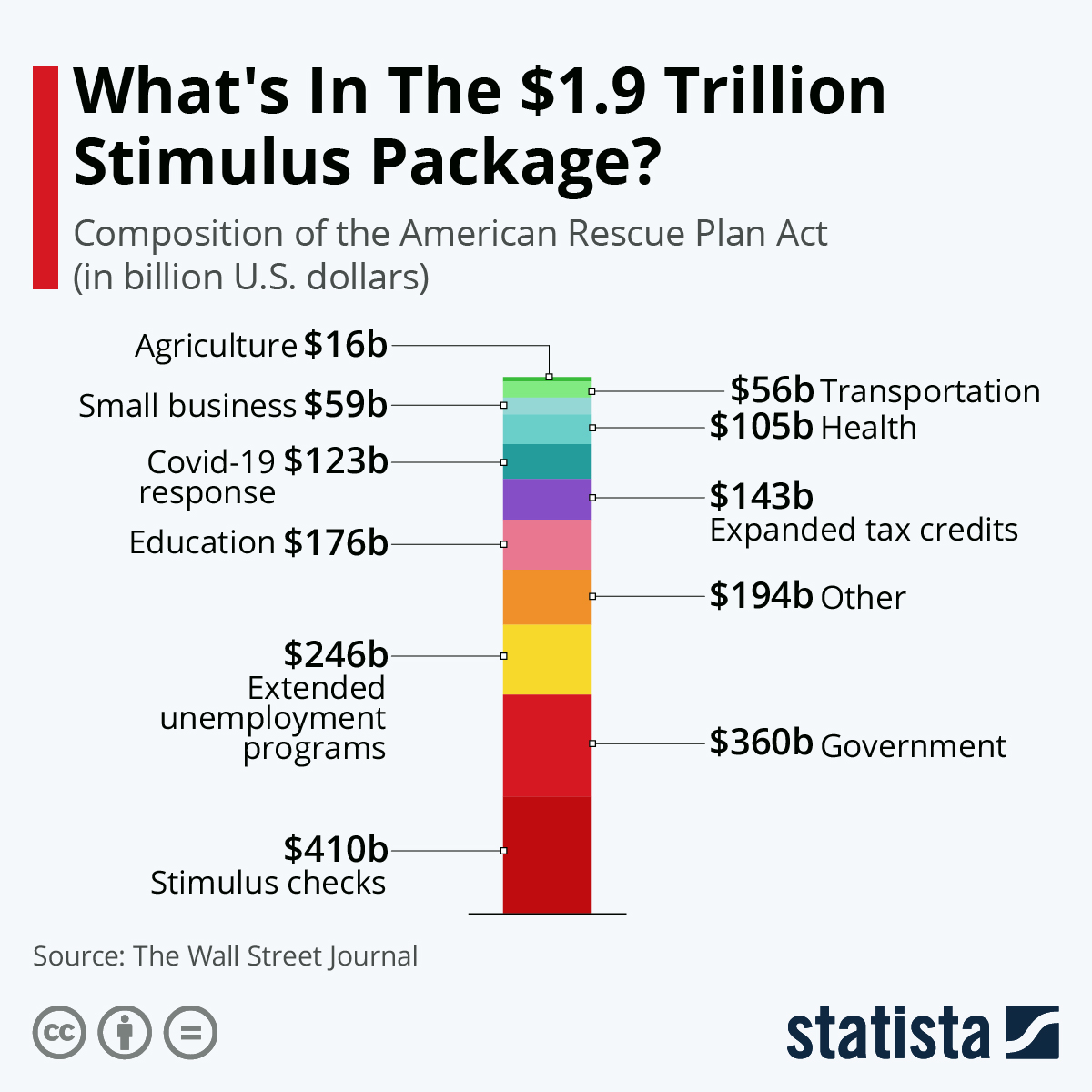

The current recovery is about to get an additional major boost from the recently passed $1.9 trillion “American Rescue Plan Act,” the first part of President Joe Biden’s promise to “build back better.” Combined with previously enacted stimulus packages, a total of $5.3 trillion will ultimately have been pumped into the economy to keep people and businesses afloat and support public health.

To say this amount of stimulus is extraordinary is an understatement. Previously, the $787 billion American Recovery and Reinvestment Act of 2009 was the largest stimulus bill in US history. Three larger packages have passed in just 12 months and they are making a difference.

Unemployment has fallen to 6.0% in March from last April’s high of nearly 15%, though it is still nearly double the five-decade low rate of 3.5% in February 2020. Even with about 10 million people still out of work, we may find US GDP fully recovered 2020’s losses in the first quarter when the Bureau of Economy Activity releases its first reading in late April. The fastest tumble into a recession has been followed by the fastest recovery. Likewise, earnings of S&P 500 companies in 2021 are expected to recover last year’s losses and expand beyond 2019’s record highs.

Will inflation dampen real growth?

Stocks may have continued trending higher in 2021 but bonds are another story. Last April, the yield on 10-year Treasury bonds reached a record low of 0.58% as investors rushed to buy safer investments and the Federal Reserve supported financial markets through a new round of bond purchases. Since that point, yields rose to end 2020 at 0.93% and have only accelerated to end the first quarter at 1.74%.

The Federal Reserve has every intention of keeping rates low, so the only reason interest rates would jump like this is the expectation of rising inflation. Experts have almost continually predicted higher inflation ever since the Fed’s first Quantitative Easing program was instituted in 2008, but it just has not materialized to date. That might be about to change.

For one, the Fed is effectively printing a massive amount of money to fund the past year’s $5.3 trillion in stimulus. Every new dollar created makes already existing dollars less valuable because there are now more dollars available to buy the same amount of goods and services.

The M2 money stock is a popular measure of how many dollars are circulating in the economy. The current influx far surpasses all the actions taken back in 2008 and 2009. The spike in dollars available over the past year does not even yet reflect the spending coming from the recently passed $1.9 trillion American Rescue Plan or another potential $2.3 trillion the Biden administration is considering spending on infrastructure and green energy.

On top of this, the economy is clearly heating up as cash that has been sitting on the sidelines and stimulus money is put to work. As more and more businesses do better, they will need to compete and pay higher prices to buy supplies and hire additional workers and will in turn need to raise prices on the goods and services they provide.

The implications of inflation for consumers are clear but maybe less so for investors. For one, many companies may not be able to raise prices to the same degree that their costs rise, resulting in falling profits over the short-term. Also, as interest rates rise, borrowing money becomes more expensive. Even small rate shocks can be devastating for highly leveraged companies that live on the edge. Unfortunately, after years of easy money policy in the US, there are a lot of firms, large and small, which fit this description.

The good news is that, for now, interest rates are still historically low. The recent rise only wound the clock back to where rates began in 2020. The speed of the rise is what has caught Wall Street’s attention. US Treasuries are considered to be one of the safest, least-volatile investments available. The fact that the yield on the 10-year Treasury could nearly double in the first three months of 2021 is shocking. With the Fed still working to maintain low borrowing costs, we expect the current upswing to taper off, but continue to own inflation-protected Treasury bonds to help shield a portion of our fixed income portfolio from rising inflation.

When everyone’s excited, we get nervous

Last year, we talked about cash building up on the sidelines, waiting to be put to work. The world is slowly approaching something closer to normal and investors have clearly been searching for returns. For the most part, funds are going into traditional investments of stocks and bonds, but we’ve seen an influx of hot investments already in 2021.

Apart from meme stocks like GameStop that have been in the news, companies going public for the first time have raised a record $162 billion already in 2021. Over half of that amount has been raised by special purpose acquisition companies (SPACs). A SPAC is a publicly traded shell company set up by sponsors to raise cash from investors with the promise to use the cash to buy as-yet-identified private companies in the future. The technique itself has been around for decades, but has become immensely popular in the last few years as sponsors have realized that investors are hungry for the opportunity to own shares in newly public companies, especially those from certain industry sectors like technology, bio-tech, entertainment, and finance. We think the SPAC model is likely here to stay; it offers an alternative way to take a company public while avoiding many of the compliance related steps required by the SEC in a normal IPO process.

If that sounds like a recipe for a bad outcome, it might be. Some SPACS may serve investors well. But we are concerned about the pricing, transparency, and reporting requirements. The way most SPACs are structured, the sponsors are almost certain to make a lot of money while taking no risk. You can’t say the same for investors in SPACs. They will invest without knowing which company they will ultimately own and at what price they will purchase it. Their investment will immediately be significantly diluted by the share due to the sponsors. Numerous SPACs have been rolled out with celebrities named as part of the sponsor team. For example, MLB All Star Alex Rodriguez is CEO of SLAM Inc., a SPAC raising $500 million to invest in sports, media, entertainment, or health and wellness companies. It is likely that SPAC pricing, disclosure, and terms will improve in the future. Until then, we worry that their popularity represents a market that is getting frothy.

Blockchain investments have taken off as well. The best known example, Bitcoin, soared well past $1 trillion in total value with investments from a handful of companies like Tesla. Another blockchain phenomenon called Non-Fungible Tokens (NFTs) have recently received significant press. A digital file or NFT in the form of a collage of over 5,000 pictures was sold by the digital artist Beeple for $69.3 million. You can read more about blockchain in Benton Bragg’s 1st Quarter Commentary.

As investors, we research all kinds of investments and needless to say, the amount of excitement we’re seeing around SPACs and NFTs makes us a little anxious.

The “Great Reopening” is gathering speed

We’re still in a pandemic. Probably the most important statistic to watch this quarter is the count of vaccines administered in the US and around the globe. As of this writing, 150 million vaccine doses have been administered in the US and 578 million have been administered globally. Without that resistance to COVID-19, all of the stimulus passed is just temporary life support. The switch that turned off the economy last March doesn’t turn back on as quickly. If we can reach herd immunity this year, we should see real, sustainable growth take hold. That’s important because at some point in the future we’ll need to pay back all the money our government is spending.

We can’t say if inflation or an asset bubble in fad investments will send markets lower or if the “Great Reopening” and rising profits will bring more strong gains, but it’s safe to say the next twelve months won’t offer the same returns as the past twelve.

At an inflection point like this, it’s important to own a diversified portfolio with an appropriate mix of stocks for growth and bonds for protection. Diversification is likely to be more successful than trying to pick what will lead the market next, and prevents you from missing out if you are wrong. The single most important portfolio decision an investor makes is setting that balance between growth and protection. If you would like to review your portfolio, please give us a call. We are open.

Bragg Sponsors Ken Burns’ Film Hemingway on PBS Charlotte

March 26, 2021Donkeys for Sale: 1st Quarter 2021 Commentary

March 31, 2021Market and Economy

What a difference a year makes! With the world shut down a year ago, stocks were experiencing the most abrupt bear market in US history. Four consecutive quarters of rising stocks later and investors who stayed the course have been rewarded with a spectacular 12-month return. All the major stock indexes we track have reached new all-time highs in the past few months.

The economy is reopening as vaccine distribution accelerates and new government stimulus encourages companies and consumers to put a glut of cash savings to use. Optimism is clearly rising and has spread across all facets of the stock market.

The big winners during last year’s COVID shutdowns were the tech-oriented companies that helped us work, shop, and entertain ourselves from home. As vaccination counts grow and we venture back out into the world, the other, harder-hit companies are rising as “recovery” stocks have recently outpaced “pandemic” stocks. The disparity is obvious looking at how much small-company stocks have outperformed their larger peers over the last 12 months.

American Rescue Plan

The current recovery is about to get an additional major boost from the recently passed $1.9 trillion “American Rescue Plan Act,” the first part of President Joe Biden’s promise to “build back better.” Combined with previously enacted stimulus packages, a total of $5.3 trillion will ultimately have been pumped into the economy to keep people and businesses afloat and support public health.

To say this amount of stimulus is extraordinary is an understatement. Previously, the $787 billion American Recovery and Reinvestment Act of 2009 was the largest stimulus bill in US history. Three larger packages have passed in just 12 months and they are making a difference.

Unemployment has fallen to 6.0% in March from last April’s high of nearly 15%, though it is still nearly double the five-decade low rate of 3.5% in February 2020. Even with about 10 million people still out of work, we may find US GDP fully recovered 2020’s losses in the first quarter when the Bureau of Economy Activity releases its first reading in late April. The fastest tumble into a recession has been followed by the fastest recovery. Likewise, earnings of S&P 500 companies in 2021 are expected to recover last year’s losses and expand beyond 2019’s record highs.

Will inflation dampen real growth?

Stocks may have continued trending higher in 2021 but bonds are another story. Last April, the yield on 10-year Treasury bonds reached a record low of 0.58% as investors rushed to buy safer investments and the Federal Reserve supported financial markets through a new round of bond purchases. Since that point, yields rose to end 2020 at 0.93% and have only accelerated to end the first quarter at 1.74%.

The Federal Reserve has every intention of keeping rates low, so the only reason interest rates would jump like this is the expectation of rising inflation. Experts have almost continually predicted higher inflation ever since the Fed’s first Quantitative Easing program was instituted in 2008, but it just has not materialized to date. That might be about to change.

For one, the Fed is effectively printing a massive amount of money to fund the past year’s $5.3 trillion in stimulus. Every new dollar created makes already existing dollars less valuable because there are now more dollars available to buy the same amount of goods and services.

The M2 money stock is a popular measure of how many dollars are circulating in the economy. The current influx far surpasses all the actions taken back in 2008 and 2009. The spike in dollars available over the past year does not even yet reflect the spending coming from the recently passed $1.9 trillion American Rescue Plan or another potential $2.3 trillion the Biden administration is considering spending on infrastructure and green energy.

On top of this, the economy is clearly heating up as cash that has been sitting on the sidelines and stimulus money is put to work. As more and more businesses do better, they will need to compete and pay higher prices to buy supplies and hire additional workers and will in turn need to raise prices on the goods and services they provide.

The implications of inflation for consumers are clear but maybe less so for investors. For one, many companies may not be able to raise prices to the same degree that their costs rise, resulting in falling profits over the short-term. Also, as interest rates rise, borrowing money becomes more expensive. Even small rate shocks can be devastating for highly leveraged companies that live on the edge. Unfortunately, after years of easy money policy in the US, there are a lot of firms, large and small, which fit this description.

The good news is that, for now, interest rates are still historically low. The recent rise only wound the clock back to where rates began in 2020. The speed of the rise is what has caught Wall Street’s attention. US Treasuries are considered to be one of the safest, least-volatile investments available. The fact that the yield on the 10-year Treasury could nearly double in the first three months of 2021 is shocking. With the Fed still working to maintain low borrowing costs, we expect the current upswing to taper off, but continue to own inflation-protected Treasury bonds to help shield a portion of our fixed income portfolio from rising inflation.

When everyone’s excited, we get nervous

Last year, we talked about cash building up on the sidelines, waiting to be put to work. The world is slowly approaching something closer to normal and investors have clearly been searching for returns. For the most part, funds are going into traditional investments of stocks and bonds, but we’ve seen an influx of hot investments already in 2021.

Apart from meme stocks like GameStop that have been in the news, companies going public for the first time have raised a record $162 billion already in 2021. Over half of that amount has been raised by special purpose acquisition companies (SPACs). A SPAC is a publicly traded shell company set up by sponsors to raise cash from investors with the promise to use the cash to buy as-yet-identified private companies in the future. The technique itself has been around for decades, but has become immensely popular in the last few years as sponsors have realized that investors are hungry for the opportunity to own shares in newly public companies, especially those from certain industry sectors like technology, bio-tech, entertainment, and finance. We think the SPAC model is likely here to stay; it offers an alternative way to take a company public while avoiding many of the compliance related steps required by the SEC in a normal IPO process.

If that sounds like a recipe for a bad outcome, it might be. Some SPACS may serve investors well. But we are concerned about the pricing, transparency, and reporting requirements. The way most SPACs are structured, the sponsors are almost certain to make a lot of money while taking no risk. You can’t say the same for investors in SPACs. They will invest without knowing which company they will ultimately own and at what price they will purchase it. Their investment will immediately be significantly diluted by the share due to the sponsors. Numerous SPACs have been rolled out with celebrities named as part of the sponsor team. For example, MLB All Star Alex Rodriguez is CEO of SLAM Inc., a SPAC raising $500 million to invest in sports, media, entertainment, or health and wellness companies. It is likely that SPAC pricing, disclosure, and terms will improve in the future. Until then, we worry that their popularity represents a market that is getting frothy.

Blockchain investments have taken off as well. The best known example, Bitcoin, soared well past $1 trillion in total value with investments from a handful of companies like Tesla. Another blockchain phenomenon called Non-Fungible Tokens (NFTs) have recently received significant press. A digital file or NFT in the form of a collage of over 5,000 pictures was sold by the digital artist Beeple for $69.3 million. You can read more about blockchain in Benton Bragg’s 1st Quarter Commentary.

As investors, we research all kinds of investments and needless to say, the amount of excitement we’re seeing around SPACs and NFTs makes us a little anxious.

The “Great Reopening” is gathering speed

We’re still in a pandemic. Probably the most important statistic to watch this quarter is the count of vaccines administered in the US and around the globe. As of this writing, 150 million vaccine doses have been administered in the US and 578 million have been administered globally. Without that resistance to COVID-19, all of the stimulus passed is just temporary life support. The switch that turned off the economy last March doesn’t turn back on as quickly. If we can reach herd immunity this year, we should see real, sustainable growth take hold. That’s important because at some point in the future we’ll need to pay back all the money our government is spending.

We can’t say if inflation or an asset bubble in fad investments will send markets lower or if the “Great Reopening” and rising profits will bring more strong gains, but it’s safe to say the next twelve months won’t offer the same returns as the past twelve.

At an inflection point like this, it’s important to own a diversified portfolio with an appropriate mix of stocks for growth and bonds for protection. Diversification is likely to be more successful than trying to pick what will lead the market next, and prevents you from missing out if you are wrong. The single most important portfolio decision an investor makes is setting that balance between growth and protection. If you would like to review your portfolio, please give us a call. We are open.

SEE ALSO:

Donkeys for Sale: 1st Quarter 2021 Commentary, Published by Benton Bragg, CFA, CFP®More About...

The Tax Valley: A Hidden Opportunity for Retirees

Read more

Bridge Loan Bootcamp

Read more

Donating in Retirement: Give More and Owe Less with QCDs

Read more

Decanting a Trust: Pouring Old Wine into a New Bottle

Read more

Trump Accounts: A New Vehicle for Long-Term Savings

Read more

Understanding the One Big Beautiful Bill and Its Tax Changes

Read more

Investment Ingredients: Combining Assets for Optimal Returns

Read more

Harvesting the Loss: When Does It Make Sense?

Read more

Playing Catch-Up: Making Extra Contributions for Retirement

Read more