Market and Economy

The new year started with so much promise. The US economy had grown, albeit slowly, for eleven consecutive years and was expected to continue doing so in 2020. Trade talks between the US and China were progressing. Stocks were rising in January—until the first reports out of China of an outbreak of a new coronavirus.

As COVID-19 grew into a pandemic and spread quickly across the world, global stock markets plummeted. In the US, the longest duration bull market in history ended with the fastest decline in history. It took just 20 days for the S&P 500 to fall over 20% from an all-time high on February 19th—even faster than the market crashes of 1929 and 1987. Unfortunately, it fell further than 20%. By the market close on March 23rd, the S&P was down 34% from its high. Then, responding to the passage of the $2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the S&P rallied by 20% in just three trading days ending March 26 before trending down somewhat to end the quarter down 23.7% from its February peak. For the full quarter, the S&P was off 19.6%.

Small-cap stocks (-30.6%) and mid-cap stocks (-27.1%), which typically have weaker balance sheets and less diversified revenue sources, were hit harder. Foreign stock markets were down more than US large-cap stocks, possibly because the virus cycle started earlier in Asia and Europe.

If you merely look at the Barclays US Aggregate Bond Index’s return of 3.1% through March you might conclude that bonds were a safe haven throughout the storm that rocked stock markets. In fact, in mid-March, the selloff even spread to bonds as the Barclays bond index fell nearly 10% over a week and a half as investors sold securities of all types in a desperate effort to raise cash. After bottoming on March 19th, bond prices recovered most of their losses, primarily as a result of actions taken by the Fed to stabilize trading and provide liquidity. Compared to taxable bonds, volatility in the municipal bond market was more severe. While the Barclays Municipal Bond Index ended the quarter down only slightly at -0.6%, the index fell more than 14% in mid-March for the liquidity reasons mentioned above but also because investors are worried about the negative impact on municipalities from lower tax revenues.

| Market Index Returns as of March 31, 2020 |

| Index |

1st Quarter |

1 Year |

3 Years |

5 Years |

10 Years |

| S&P 500 (US Large Cap) |

-19.6% |

-7.0% |

5.1% |

6.7% |

10.5% |

| Russell Midcap (US Mid Cap) |

-27.1% |

-18.3% |

-0.8% |

1.9% |

8.8% |

| Russell 2000 (US Small Cap) |

-30.6% |

-24.0% |

-4.6% |

-0.3% |

6.9% |

| MSCI ACWI X-US IMI Net (Foreign Equity) |

-24.1% |

-16.3% |

-2.3% |

-0.7% |

2.1% |

| MSCI EM (Foreign Emerging) |

-23.6% |

-17.7% |

-1.6% |

-0.4% |

0.7% |

| Barclays Aggregate Bond |

3.2% |

8.9% |

4.8% |

3.4% |

3.9% |

| Barclays Muni Bond |

-0.6% |

3.9% |

4.0% |

3.2% |

4.1% |

| Past performance is not an indication of future performance. |

The Cost of Social Distancing

To “flatten the curve” of the number of coronavirus infections, “non-essential” businesses have been closed while much of the still-employed workforce is working from home. The solution to halting the spread of the virus has halted the global economy as well. Even without official GDP measurements that will take time to be released, we can say with certainty that the economy is in recession.

As a frame of reference, let’s look at the past recessions. When the DotCom bubble burst in 2001, a fairly shallow recession followed as US GDP fell 0.3% and unemployment rose to 6.3%. The financial crisis just over ten years ago was much worse as US GDP fell 5.1% and unemployment jumped to 10.0%. During the Great Depression, the deepest contraction in the past century, GDP fell 24.9% and unemployment rose to 26.7%.

| Recession |

Period Range |

Duration (months) |

Peak Unemployment |

GDP decline (peak to trough) |

| Great Depression |

Aug 1929–Mar 1933 |

43 |

24.9% |

−26.7% |

| Recession of 1937–1938 |

May 1937–June 1938 |

13 |

17.8% |

−18.2% |

| Post WWII Recession |

Feb 1945–Oct 1945 |

8 |

5.2% |

−12.7% |

| WWII-Bond Recession |

Nov 1948-Oct 1949 |

11 |

7.9% |

-1.7 |

| Post Korean War Recession |

Jul 1953-May 1954 |

10 |

6.1% |

-2.6 |

| Eisenhower Recession |

Aug 1957-Apr 1958 |

8 |

7.5% |

-3.7 |

| Monetary Recession |

Apr 1960-Feb 1961 |

10 |

7.1% |

-1.6 |

| Vietnam War Recession |

Dec 1969-Nov 1970 |

11 |

6.1% |

-0.6 |

| Oil Crisis |

Nov 1973–Mar 1975 |

16 |

9.0% |

−3.2% |

| First Volcker Recession |

Jan 1980–July 1980 |

6 |

7.8% |

−2.2% |

| Second Volcker Recession |

July 1981–Nov 1982 |

16 |

10.8% |

−2.7% |

| Gulf War Recession |

July 1990–Mar 1991 |

8 |

7.8% |

−1.4% |

| DotCom Bubble |

Mar 2001–Nov 2001 |

8 |

6.3% |

−0.3% |

| Global Financial Crisis |

Dec 2007–June 2009 |

18 |

10.0% |

−5.1% |

Sources: US Bureau of Labor Statistics, National Bureau of Economic Research

Estimates for first-quarter GDP declines range up to as much as 10% but forecasts for the second quarter are truly shocking. Here are some of the estimates for year-over-year GDP declines for the second quarter: Goldman Sachs -24%, JPMorgan -25%, and Morgan Stanley -30%.

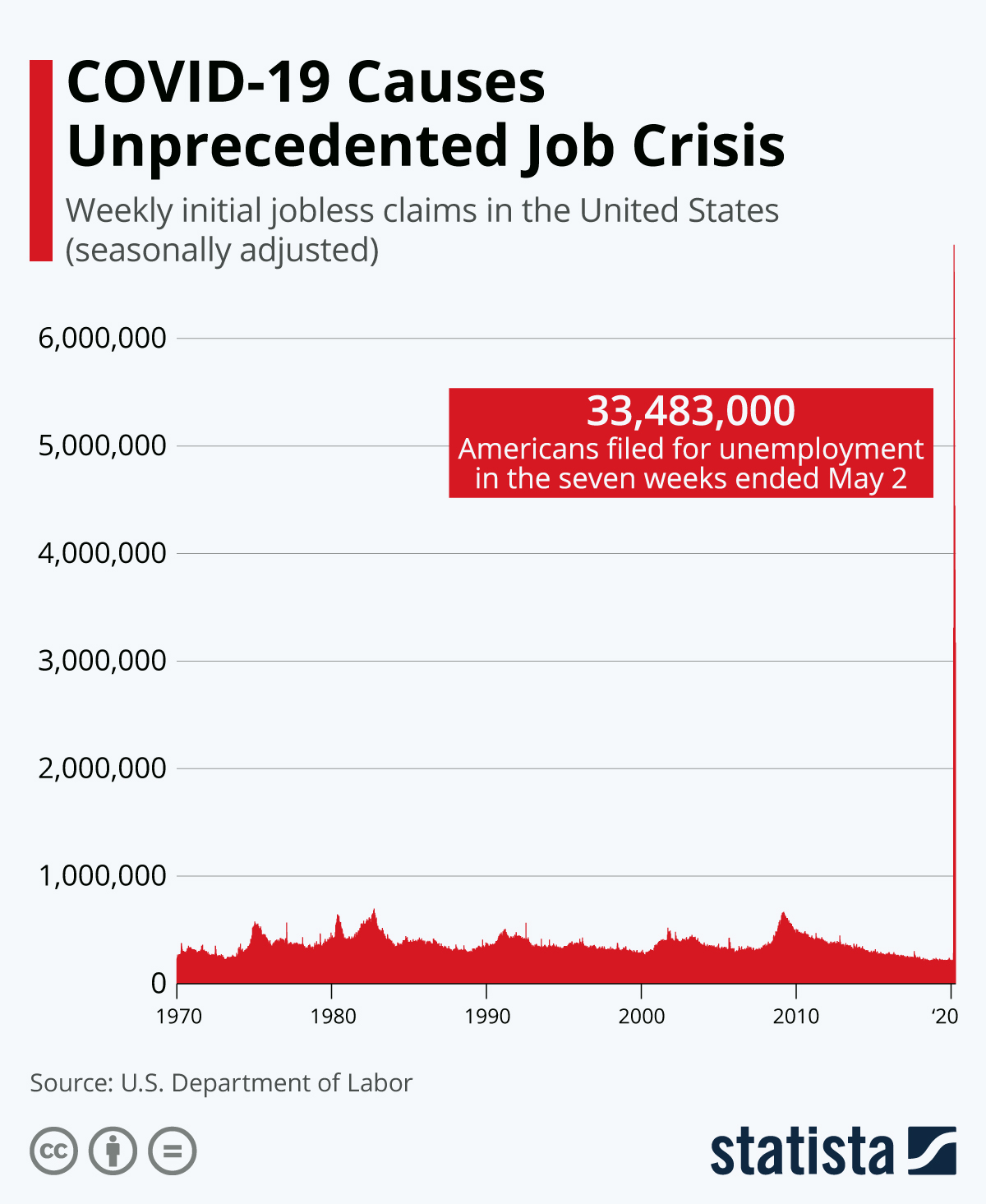

The effects of shelter in place and social distancing are already showing in new claims for unemployment as layoffs and furloughs have begun. After averaging roughly 200,000 to 225,000 new claims per week in the US for the past several years, a record 3.28 million people filed for unemployment in the week ended March 21. The following week, another record was set as new claims doubled to 6.6 million.

In just two weeks’ time, almost 10 million Americans are either temporarily or permanently out of a job. Hovering around five-decade lows at 3.6% in February, the US unemployment rate spiked to 4.4% in March—the largest one-month jump since 1975—and will certainly jump by more next month.

Plummeting oil prices have not helped matters. After Russia balked at cutting production along with the rest of OPEC, Saudi Arabia responded by flooding the market with even more oil. This massive increase in oil supply coinciding with an equally large collapse in oil demand due to the coronavirus has crushed the energy sector and pushed oil prices down by more than half to 18-year lows. While the energy sector makes up just 2.6% of the S&P 500 as of March 31st, oil and gas make up a larger portion of US GDP and has wider reach when you consider ancillary businesses and lending from banks and other financial entities.

Financial Remedies

In the face of such dire forecasts, the Federal Reserve acted swiftly by cutting the Fed Funds rate a full 1% to zero, along with announcing its fourth quantitative easing (QE) program. Initially, the Fed vowed to buy up to $700 billion in Treasuries and agency bonds to ensure liquidity but the cap was quickly lifted and purchases are also being expanded to municipal and corporate bonds. With what is being called “QE Infinity,” the Fed has vowed to do whatever it takes to ensure liquidity in the credit markets.

The Fed also announced several new lending facilities such as directly offering dollars for Treasuries held by foreign central banks to prevent them from selling in the open market. It took over six years for the Fed balance sheet to grow by $3.6 trillion coming out of the financial crisis. We may see it grow by a larger amount in just a couple of months.

Not to be outdone, Congress moved quickly to pass legislation that was signed into law by President Trump on March 27, creating its massive $2 trillion stimulus package. The CARES Act will help provide medical care resources and financial relief to help keep the country afloat while we deal with COVID-19. Covered in more detail in articles by Marc Scavo and by Mary Lou Daly, the Act will result in increased unemployment benefits as well as direct cash payments to millions of individuals and loans to potentially thousands of small businesses.

The CARES Act also provides loans to specific large companies in many of the hardest-hit industries, but with some strings attached. For example, US airlines accepting money cannot lay off or furlough employees or reduce their pay. These companies also cannot pay dividends or buy back company stock for over a year.

The Act devotes $349 billion in grants and loans to small businesses and nonprofits. Loan payments will start after six months and any part of the loan used for employee pay, rent, utilities, and mortgage interest will be forgiven. The amount forgiven will be reduced if any employees are laid off. These business loans will be crucial considering a study by the JPMorgan Chase Institute that found that half of small businesses have cash on hand to cover just 27 days or fewer of expenses.

Asia and Europe Ahead of US in the Virus Cycle

The financial story is similar all across the world, though most other large economies are ahead of the US in terms of the virus cycle. Foreign central banks and governments have enacted large stimulus packages as countries deal with widespread shutdowns. For comparison to the US, JPMorgan is projecting -15% and -22% contractions in economic output for the Eurozone in the first and second quarters.

Emerging markets may lead the world out of this recession. China, which was the first country to deal with COVID-19 and which took possibly the most draconian steps to halt its spread, likely took most of its economic hit in the first quarter and will start seeing a rebound in the second quarter. South Korea should look very similar.

So Are Stocks Cheap?

That is a tough question to answer right now. We know that prices, as measured by the broad market indices, are down more than 20% from recent highs. The prices of some companies (energy, travel, lodging, financials, restaurants) are down far more while other companies (consumer staples, healthcare, grocery, technology) have fared significantly better. We know what the prices are; we simply have very little visibility as to what earnings will be. Current price to earnings (P/E) ratios are of little value because stock prices tumbled much faster than earnings expectations have fallen. According to FactSet, analysts are now projecting declines in 2020 quarterly earnings for the S&P 500 in the first quarter (-5.2%), second quarter (-10.0%), and third quarter (-1.1%). These estimates are likely still too high and we expect to see further downward revisions. Even with the earnings rebound expected in the fourth quarter, we will likely see the first double-digit decline in annual earnings in over a decade. As investors, we hesitate to say if stocks are cheap at any given time; history has shown that this exercise has rarely proven to be of value. We don’t know exactly how much earnings will fall or how long major portions of the economy will be locked down. We do know that there is a lot of uncertainty in the market right now and we sense that many investors are sitting tight waiting to see if the CARES Act stimulus and the aggressive actions of the Federal Reserve will support the economy long enough to get business moving again. We take comfort in knowing we have significant liquidity in our portfolios and that we have relatively small exposure to energy, travel, and retail stocks.

Life after Corona

I heard once that in life there are good times and there are times you will get through. This is a time we will get through. Social distancing, mass testing and other actions will eventually stem the tide of the virus as we have seen in China and South Korea, each of which has seen its number of new cases slow to fewer than 100 per day. As shown in the chart below, we are seeing a slowing in the growth rate of new infections in Italy, Germany, France and other parts of the world that have been hit hard.

On Sunday, April 5, Dr. Deborah Birx, White House Coronavirus Response Coordinator, said that several U.S. hotspots such as the Detroit area, New York and Louisiana could reach their mortality peaks during the next week. She cited models created by the Institute for Health Metrics and Evaluation (IHME) at the University of Washington. These models allow you to research projected peak infection and mortality statistics by state. For example, according to the website, NY will see its mortality rate peak on April 10 while NC will see its mortality rate peak on April 28. The researchers maintaining the website models update their data and projections regularly.

Obviously, the sooner we return to normal the better. It is just a question of how bad things will get first. While the depth of this recession may be deeper than what we’ve seen in recent decades, it may also be shorter because the Federal Reserve and CARES Act have given the US economy a strong foundation to return to growth quickly. There remains a chance that we may see a significantly faster than average economic recovery as a bookend to the fastest ever economic contraction.

At Bragg Financial Advisors, we are rebalancing portfolios while considering client liquidity needs. In many cases we are using this opportunity to further diversify portfolios. An example of this is harvesting portfolio losses which can be used to offset gains taken when we trim large, highly-appreciated positions. Throughout the extended bull market of the last ten years, our regular rebalancing meant years of taking stock profits off the table to build up a base of safer bond holdings. Today we are adding to stocks while prices are lower.

As always, we recommend maintaining a long-term investment approach. Below are charts from the last nine recessions. The price action of the S&P 500 (shown in green) and the movement of the unemployment rate (purple) are shown during each recession (shaded in gray). In eight out of nine cases, stocks bottomed and started rising before the recessions ended or unemployment peaked. Markets are forward-looking. In this case, the market is looking past the crisis, trying to determine the depth of the recession and the level of earnings expected in the future. This doesn’t mean that markets won’t fall from here. Stocks may retest the lows of March or go even lower. We simply think it’s important to remember that trying to call the bottom will be very difficult.

We hope this information is useful. Please call us if you would like to discuss your portfolio.

Welcome Marc Scavo to the Bragg Team

April 3, 20201st Quarter 2020: After the Virus

April 5, 2020Market and Economy

The new year started with so much promise. The US economy had grown, albeit slowly, for eleven consecutive years and was expected to continue doing so in 2020. Trade talks between the US and China were progressing. Stocks were rising in January—until the first reports out of China of an outbreak of a new coronavirus.

As COVID-19 grew into a pandemic and spread quickly across the world, global stock markets plummeted. In the US, the longest duration bull market in history ended with the fastest decline in history. It took just 20 days for the S&P 500 to fall over 20% from an all-time high on February 19th—even faster than the market crashes of 1929 and 1987. Unfortunately, it fell further than 20%. By the market close on March 23rd, the S&P was down 34% from its high. Then, responding to the passage of the $2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the S&P rallied by 20% in just three trading days ending March 26 before trending down somewhat to end the quarter down 23.7% from its February peak. For the full quarter, the S&P was off 19.6%.

Small-cap stocks (-30.6%) and mid-cap stocks (-27.1%), which typically have weaker balance sheets and less diversified revenue sources, were hit harder. Foreign stock markets were down more than US large-cap stocks, possibly because the virus cycle started earlier in Asia and Europe.

If you merely look at the Barclays US Aggregate Bond Index’s return of 3.1% through March you might conclude that bonds were a safe haven throughout the storm that rocked stock markets. In fact, in mid-March, the selloff even spread to bonds as the Barclays bond index fell nearly 10% over a week and a half as investors sold securities of all types in a desperate effort to raise cash. After bottoming on March 19th, bond prices recovered most of their losses, primarily as a result of actions taken by the Fed to stabilize trading and provide liquidity. Compared to taxable bonds, volatility in the municipal bond market was more severe. While the Barclays Municipal Bond Index ended the quarter down only slightly at -0.6%, the index fell more than 14% in mid-March for the liquidity reasons mentioned above but also because investors are worried about the negative impact on municipalities from lower tax revenues.

The Cost of Social Distancing

To “flatten the curve” of the number of coronavirus infections, “non-essential” businesses have been closed while much of the still-employed workforce is working from home. The solution to halting the spread of the virus has halted the global economy as well. Even without official GDP measurements that will take time to be released, we can say with certainty that the economy is in recession.

As a frame of reference, let’s look at the past recessions. When the DotCom bubble burst in 2001, a fairly shallow recession followed as US GDP fell 0.3% and unemployment rose to 6.3%. The financial crisis just over ten years ago was much worse as US GDP fell 5.1% and unemployment jumped to 10.0%. During the Great Depression, the deepest contraction in the past century, GDP fell 24.9% and unemployment rose to 26.7%.

Sources: US Bureau of Labor Statistics, National Bureau of Economic Research

Estimates for first-quarter GDP declines range up to as much as 10% but forecasts for the second quarter are truly shocking. Here are some of the estimates for year-over-year GDP declines for the second quarter: Goldman Sachs -24%, JPMorgan -25%, and Morgan Stanley -30%.

The effects of shelter in place and social distancing are already showing in new claims for unemployment as layoffs and furloughs have begun. After averaging roughly 200,000 to 225,000 new claims per week in the US for the past several years, a record 3.28 million people filed for unemployment in the week ended March 21. The following week, another record was set as new claims doubled to 6.6 million.

In just two weeks’ time, almost 10 million Americans are either temporarily or permanently out of a job. Hovering around five-decade lows at 3.6% in February, the US unemployment rate spiked to 4.4% in March—the largest one-month jump since 1975—and will certainly jump by more next month.

Plummeting oil prices have not helped matters. After Russia balked at cutting production along with the rest of OPEC, Saudi Arabia responded by flooding the market with even more oil. This massive increase in oil supply coinciding with an equally large collapse in oil demand due to the coronavirus has crushed the energy sector and pushed oil prices down by more than half to 18-year lows. While the energy sector makes up just 2.6% of the S&P 500 as of March 31st, oil and gas make up a larger portion of US GDP and has wider reach when you consider ancillary businesses and lending from banks and other financial entities.

Financial Remedies

In the face of such dire forecasts, the Federal Reserve acted swiftly by cutting the Fed Funds rate a full 1% to zero, along with announcing its fourth quantitative easing (QE) program. Initially, the Fed vowed to buy up to $700 billion in Treasuries and agency bonds to ensure liquidity but the cap was quickly lifted and purchases are also being expanded to municipal and corporate bonds. With what is being called “QE Infinity,” the Fed has vowed to do whatever it takes to ensure liquidity in the credit markets.

The Fed also announced several new lending facilities such as directly offering dollars for Treasuries held by foreign central banks to prevent them from selling in the open market. It took over six years for the Fed balance sheet to grow by $3.6 trillion coming out of the financial crisis. We may see it grow by a larger amount in just a couple of months.

Not to be outdone, Congress moved quickly to pass legislation that was signed into law by President Trump on March 27, creating its massive $2 trillion stimulus package. The CARES Act will help provide medical care resources and financial relief to help keep the country afloat while we deal with COVID-19. Covered in more detail in articles by Marc Scavo and by Mary Lou Daly, the Act will result in increased unemployment benefits as well as direct cash payments to millions of individuals and loans to potentially thousands of small businesses.

The CARES Act also provides loans to specific large companies in many of the hardest-hit industries, but with some strings attached. For example, US airlines accepting money cannot lay off or furlough employees or reduce their pay. These companies also cannot pay dividends or buy back company stock for over a year.

The Act devotes $349 billion in grants and loans to small businesses and nonprofits. Loan payments will start after six months and any part of the loan used for employee pay, rent, utilities, and mortgage interest will be forgiven. The amount forgiven will be reduced if any employees are laid off. These business loans will be crucial considering a study by the JPMorgan Chase Institute that found that half of small businesses have cash on hand to cover just 27 days or fewer of expenses.

Asia and Europe Ahead of US in the Virus Cycle

The financial story is similar all across the world, though most other large economies are ahead of the US in terms of the virus cycle. Foreign central banks and governments have enacted large stimulus packages as countries deal with widespread shutdowns. For comparison to the US, JPMorgan is projecting -15% and -22% contractions in economic output for the Eurozone in the first and second quarters.

Emerging markets may lead the world out of this recession. China, which was the first country to deal with COVID-19 and which took possibly the most draconian steps to halt its spread, likely took most of its economic hit in the first quarter and will start seeing a rebound in the second quarter. South Korea should look very similar.

So Are Stocks Cheap?

That is a tough question to answer right now. We know that prices, as measured by the broad market indices, are down more than 20% from recent highs. The prices of some companies (energy, travel, lodging, financials, restaurants) are down far more while other companies (consumer staples, healthcare, grocery, technology) have fared significantly better. We know what the prices are; we simply have very little visibility as to what earnings will be. Current price to earnings (P/E) ratios are of little value because stock prices tumbled much faster than earnings expectations have fallen. According to FactSet, analysts are now projecting declines in 2020 quarterly earnings for the S&P 500 in the first quarter (-5.2%), second quarter (-10.0%), and third quarter (-1.1%). These estimates are likely still too high and we expect to see further downward revisions. Even with the earnings rebound expected in the fourth quarter, we will likely see the first double-digit decline in annual earnings in over a decade. As investors, we hesitate to say if stocks are cheap at any given time; history has shown that this exercise has rarely proven to be of value. We don’t know exactly how much earnings will fall or how long major portions of the economy will be locked down. We do know that there is a lot of uncertainty in the market right now and we sense that many investors are sitting tight waiting to see if the CARES Act stimulus and the aggressive actions of the Federal Reserve will support the economy long enough to get business moving again. We take comfort in knowing we have significant liquidity in our portfolios and that we have relatively small exposure to energy, travel, and retail stocks.

Life after Corona

I heard once that in life there are good times and there are times you will get through. This is a time we will get through. Social distancing, mass testing and other actions will eventually stem the tide of the virus as we have seen in China and South Korea, each of which has seen its number of new cases slow to fewer than 100 per day. As shown in the chart below, we are seeing a slowing in the growth rate of new infections in Italy, Germany, France and other parts of the world that have been hit hard.

On Sunday, April 5, Dr. Deborah Birx, White House Coronavirus Response Coordinator, said that several U.S. hotspots such as the Detroit area, New York and Louisiana could reach their mortality peaks during the next week. She cited models created by the Institute for Health Metrics and Evaluation (IHME) at the University of Washington. These models allow you to research projected peak infection and mortality statistics by state. For example, according to the website, NY will see its mortality rate peak on April 10 while NC will see its mortality rate peak on April 28. The researchers maintaining the website models update their data and projections regularly.

Obviously, the sooner we return to normal the better. It is just a question of how bad things will get first. While the depth of this recession may be deeper than what we’ve seen in recent decades, it may also be shorter because the Federal Reserve and CARES Act have given the US economy a strong foundation to return to growth quickly. There remains a chance that we may see a significantly faster than average economic recovery as a bookend to the fastest ever economic contraction.

At Bragg Financial Advisors, we are rebalancing portfolios while considering client liquidity needs. In many cases we are using this opportunity to further diversify portfolios. An example of this is harvesting portfolio losses which can be used to offset gains taken when we trim large, highly-appreciated positions. Throughout the extended bull market of the last ten years, our regular rebalancing meant years of taking stock profits off the table to build up a base of safer bond holdings. Today we are adding to stocks while prices are lower.

As always, we recommend maintaining a long-term investment approach. Below are charts from the last nine recessions. The price action of the S&P 500 (shown in green) and the movement of the unemployment rate (purple) are shown during each recession (shaded in gray). In eight out of nine cases, stocks bottomed and started rising before the recessions ended or unemployment peaked. Markets are forward-looking. In this case, the market is looking past the crisis, trying to determine the depth of the recession and the level of earnings expected in the future. This doesn’t mean that markets won’t fall from here. Stocks may retest the lows of March or go even lower. We simply think it’s important to remember that trying to call the bottom will be very difficult.

We hope this information is useful. Please call us if you would like to discuss your portfolio.

SEE ALSO:

1st Quarter 2020: After the Virus, Published by Benton Bragg, CFA, CFP®More About...

Trump Accounts: A New Vehicle for Long-Term Savings

Read more

Understanding the One Big Beautiful Bill and Its Tax Changes

Read more

Investment Ingredients: Combining Assets for Optimal Returns

Read more

Harvesting the Loss: When Does It Make Sense?

Read more

Playing Catch-Up: Making Extra Contributions for Retirement

Read more

The Tortoise and the Hare: Why Most Investment Predictions Fall Short

Read more